The 9-Minute Rule for G. Halsey Wickser, Loan Agent

Table of ContentsThe Ultimate Guide To G. Halsey Wickser, Loan AgentThe Only Guide to G. Halsey Wickser, Loan AgentAn Unbiased View of G. Halsey Wickser, Loan Agent3 Easy Facts About G. Halsey Wickser, Loan Agent ShownThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Discussing

Home mortgage brokers aid prospective borrowers discover a lending institution with the finest terms and rates to fulfill their monetary demands.

All the very same, there are advantages and downsides to utilizing a mortgage broker. Working with a home loan broker can possibly save you time, initiative, and cash.

When you satisfy with feasible mortgage brokers, ask them to detail exactly how they'll aid you, all their costs, the loan providers they collaborate with, and their experience in the business. A home loan broker does as intermediator for a banks that uses finances that are secured with actual estate and individuals who wish to get realty and require a finance to do so.

Some Known Incorrect Statements About G. Halsey Wickser, Loan Agent

A lending institution is a monetary organization (or specific) that can offer the funds for the property purchase. In return, the debtor pays back the funds plus a set amount of passion over a details period of time. A lending institution can be a bank, a credit union, or other financial enterprise.

While a home loan broker isn't needed to help with the transaction, some lenders may only function with home loan brokers. If the loan provider you favor is among those, you'll need to make use of a home loan broker.

Some Known Facts About G. Halsey Wickser, Loan Agent.

When conference possible brokers, get a feel for exactly how much rate of interest they have in helping you obtain the funding you need. Ask regarding their experience, the precise help that they'll supply, the fees they bill, and just how they're paid (by loan provider or debtor).

That claimed, it is useful to do some study of your very own before fulfilling with a broker. A simple way to swiftly obtain a sense of the average rates offered for the kind of mortgage you're using for is to browse prices on-line.

G. Halsey Wickser, Loan Agent Things To Know Before You Buy

A number of various sorts of costs can be involved in tackling a new mortgage or dealing with a brand-new lending institution. These consist of source costs, application costs, and evaluation charges. In many cases, home mortgage brokers may have the ability to get lending institutions to forgo some or every one of these fees, which can conserve you hundreds to countless bucks (mortgage loan officer california).

Some lending institutions may offer home buyers the very exact same terms and prices that they provide mortgage brokers (occasionally, also much better). It never ever hurts to search by yourself to see if your broker is really supplying you a large amount. As discussed earlier, utilizing a home mortgage calculator is a simple way to fact check whether you can discover much better choices.

If the cost is covered by the lending institution, you require to be worried about whether you'll be steered to a much more expensive loan due to the fact that the payment to the broker is more financially rewarding. If you pay the fee, figure it into the home loan costs before choosing how excellent an offer you are obtaining.

10 Easy Facts About G. Halsey Wickser, Loan Agent Shown

Invest a long time getting in touch with loan providers directly to obtain an understanding of which home mortgages may be available to you. When a mortgage broker first provides you with offers from lenders, they typically use the term excellent belief estimate. This suggests that the broker believes that the deal will symbolize the last regards to the deal.

In some circumstances, the loan provider might transform the terms based upon your actual application, and you can end up paying a higher price or additional charges. This is a raising pattern because 2008, as some lenders located that broker-originated home loans were most likely to go into default than those sourced with direct loaning.

The broker will certainly accumulate info from a specific and go to numerous loan providers in order to find the best prospective car loan for their client. The broker serves as the funding officer; they collect the necessary info and job with both celebrations to obtain the funding shut.

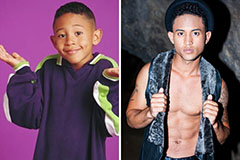

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!